According to where all the statistics are pointing, our economy over the next 2 years will provide a great opportunity for business, not just in Christchurch but nationwide.

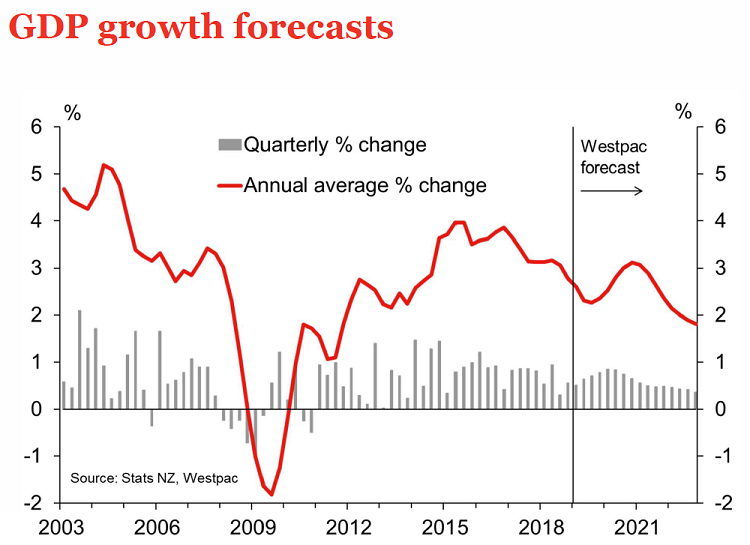

If you take a look at the above graph the predicted Gross Domestic Profit (GDP) is expected to rise another 1% over the next 2 years. So why is that?

1. Government Expenditure

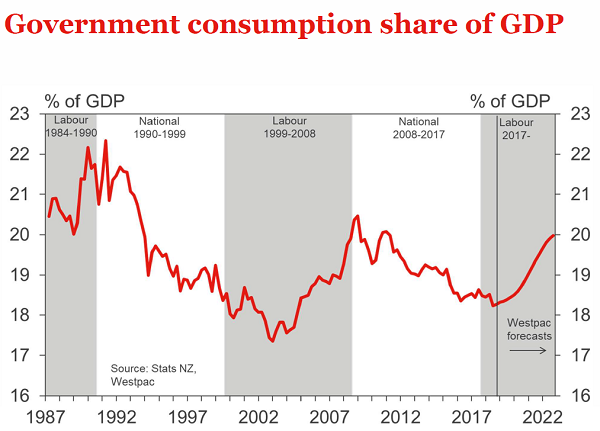

The best way to improve the economy and stimulate growth is via the private sector but public spending does help. If you refer to the graph below it really emphasises Labours forward spending which is expected over the next 2 years.

If you are not directly related to the benefits of government spending eg infrastructure, health, education etc, the flow on effect will happen with increased consumer spending as it puts more demand on products and services.

2. Increased wages

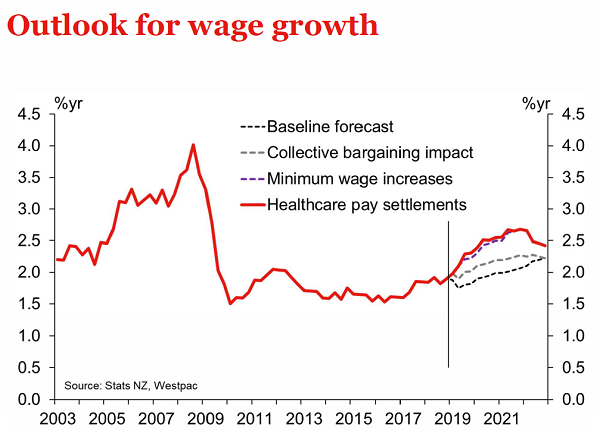

The increase in minimum wage has had an impact on almost all wages as it puts pressure on employers to keep wages consistent amongst an organisation. For those wondering how much to put wages up, take a look at the base line forecast below. It’s not too horrendous.

3. Interest Rates (OCR)

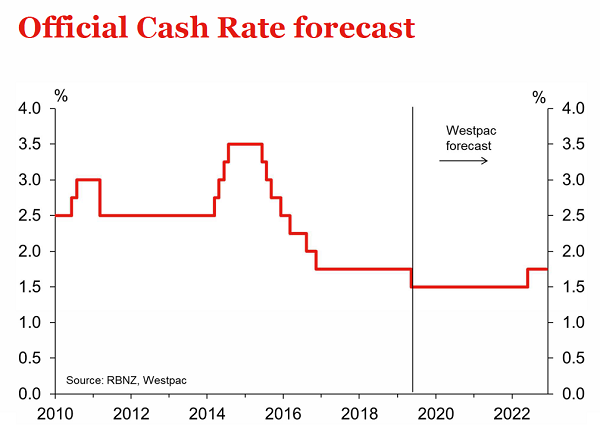

The official cash rate (OCR) is predicted to stay low over the coming 3 years which allows stability because we can rely on interest rates staying low.

This in turn allows businesses to take out loans for machinery/technology etc and the increase in spending will stimulate growth. Investing in machinery/technology will hopefully help reduce wage costs.

4. World Issues

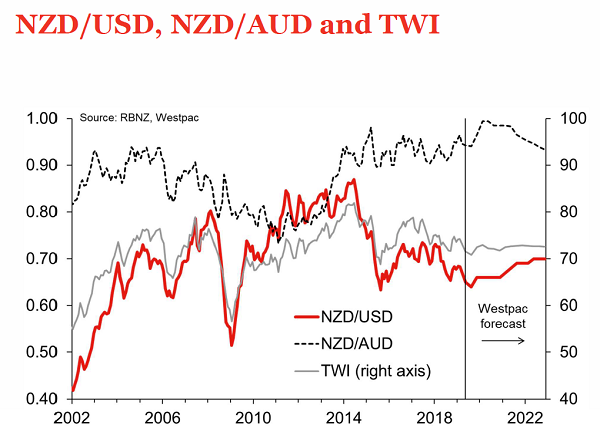

As shown below we have been living with these instabilities for a few years now. The exchange rate prediction for Australia is just about at parity with New Zealand while the USD is staying relatively stable (not so great for exporters). This helps reduce fear, create confidence and allows positive decision making around spending for growth and/or better profitability.

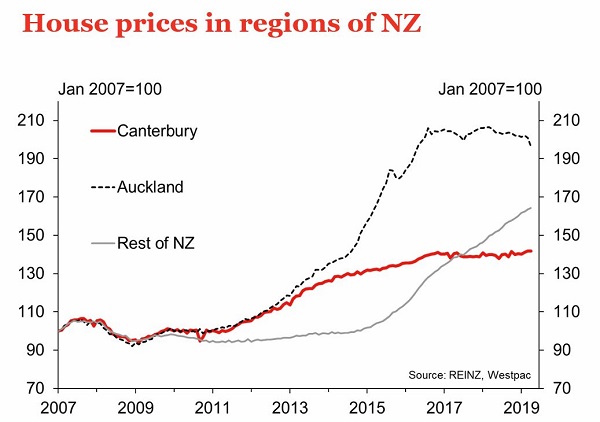

5. House prices

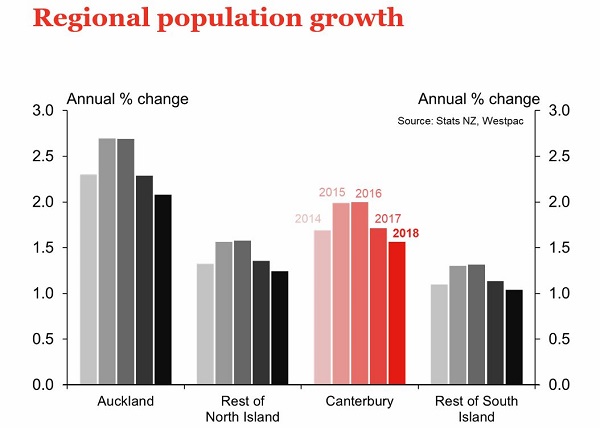

Immigration has slowed down but our population is still growing due to immigration exceeding migration.

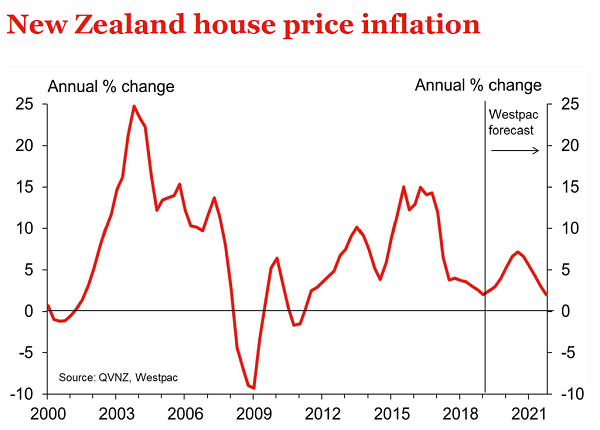

People need somewhere to live and the lower interest rates contribute to the prediction that house prices will still increase over the coming year, then fall as per the graph below:

In summary with the GDP rising and low interest rates, there’s all the reason to stay positive, continue to invest in your business and make the most out of the government spending over the coming 2 years.