Before we get into what’s been going on this week. We’d really like to acknowledge all of our lovely clients for their stick-ability and adaptability to making a change in their business. You all need a holiday after the strain you and your businesses have been through. Make sure you are taking care of yourself and take some time to reflect and congratulate yourself on a job well done. A lot of you have been outside your comfort zones for some time now, and that’s hard on you. It has been a time of personal growth and the reward is far reaching; better relationships, increased knowledge and awareness, internal empowerment and most of you would have actioned things that really matter, but they’ve been too scary for you to do in the past. Once the GDP (Gross Domestic Profit) starts moving up again, you just watch, as your leaner business should produce profit and cash like never before.

GDP has dropped by 1.6%

As you may be aware the release of our GDP (Gross Domestic Product) numbers yesterday showed a 1.6% shrinkage in our economy during the March quarter. We all know the June quarter will be a lot worse, but we all can see that recovery is underway across a broad range of sectors of the economy.

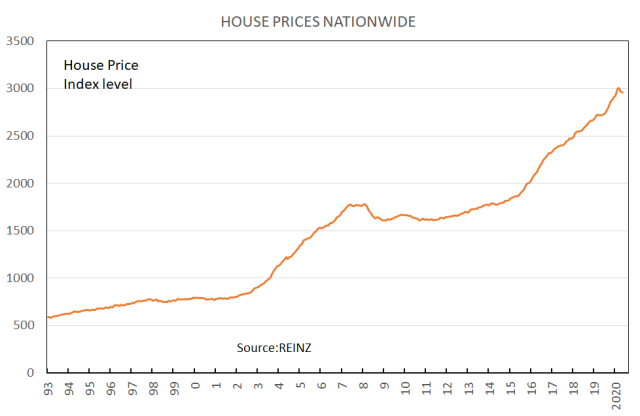

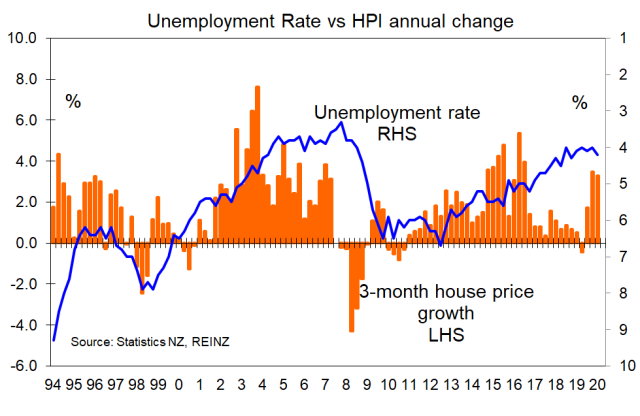

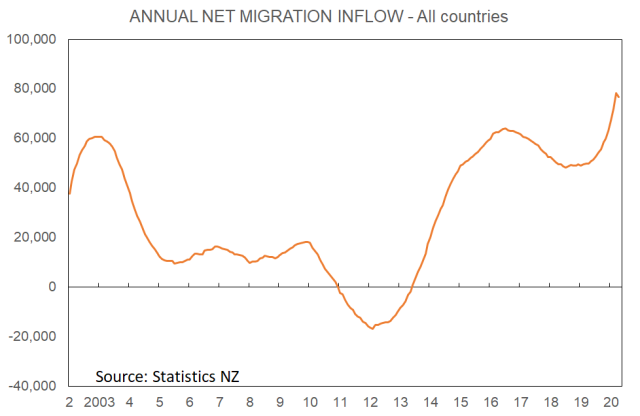

Confidence levels are improving (from low levels) and the housing market is not falling as quickly as predicted. It’s interesting to see Tony Alexander’s (Economist) view on housing prices against unemployment.

The above graphs demonstrate what has happened since the early 1990’s, and since unemployment will continue to rise until at least the end of the year, then that would suggest the housing prices will continue to fall. Low interest rates, increased consumer spending and the fact that migration was so high before the lockdown begun, will likely help soften this blow. You can read about this in more detail in Tony Alexander’s View. We have highlighted the sections that I think you may find of interest.

Some other points we have seen that are quite interesting in relation to the Gross Domestic Profit drop are:

- The GDP drop of 1.6% is the largest quarterly fall in 29 years. Paul Pascoe (National Accounts Senior Manager) said the last quarterly fall this big was in March 1991, when it dropped 2.4%.

- Only seven per cent of the March quarter was in Alert Level 4 lockdown.

- Industries related to international travel, such as accommodation and transport, began to feel the effects of Covid-19 earlier in the quarter, with activity dropping significantly once the borders closed on 19 March.

- The hospitality industry was the most impacted, falling 7.8 per cent.

- Australia’s GDP fell only 0.3 per cent, Canada fell 2.1 per cent, the UK fell 2 per cent and the US fell 1.3 per cent in the same time period.

This Week’s Opportunities

Let’s hope you get some flow on effect directly or indirectly from the below projects that have been announced:

- The Avatar project will benefit New Zealand’s economy with jobs for 400 Kiwis and projections of a $70 million spend in the next five months.

- Shovel ready projects selected – The Government is fast-tracking 11 infrastructure projects as it looks to rebuild the economy in the wake of Covid-19. The first tranche of projects approved for the new, much shorter consenting process include high density housing around the country, an upgrade of State Highway 1 between Papakura and Drury and the Auckland Harbour Bridge SkyPath. (You can find the full list of projects here.)

- The Provincial Growth Fund is providing councils and KiwiRail with $60 million to create work for local employees. Of that funding, $26 million has been allocated for rail projects and $27 million for local roading projects. The remainder will go towards supporting workers’ training for their new roles. Regional Economic Development Minister Shane Jones says the money means work can start almost immediately in areas like the Bay of Plenty, West Coast and Wairarapa.

Remember to take some time out for yourself. Here’s a lovely video that may help inspire you further in your personal and business life. 😊