Recently Louise attended the Westpac Quarterly Economic Overview , which gave us key insights into the economic landscape that Canterbury businesses should consider. Here’s Louise’s take on what you need to know:

Economic Conditions and Trends

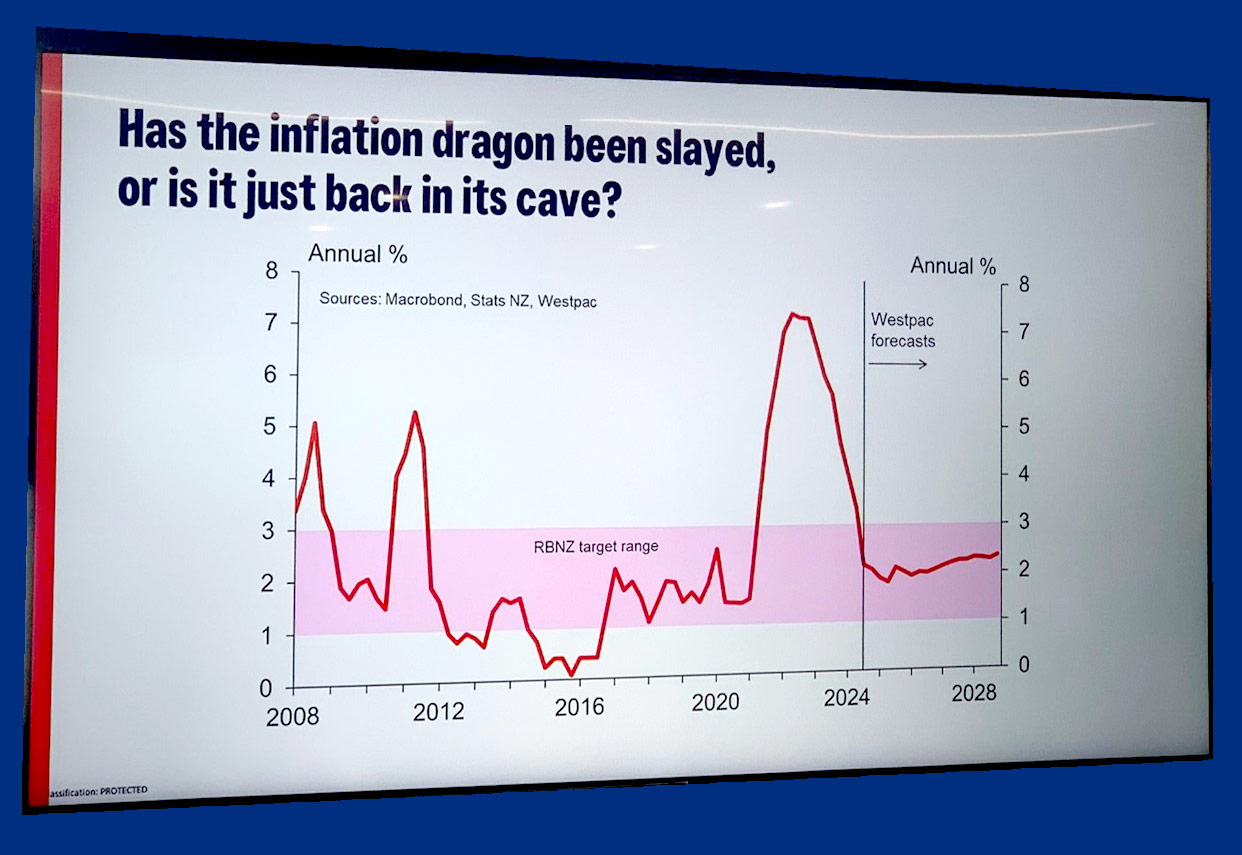

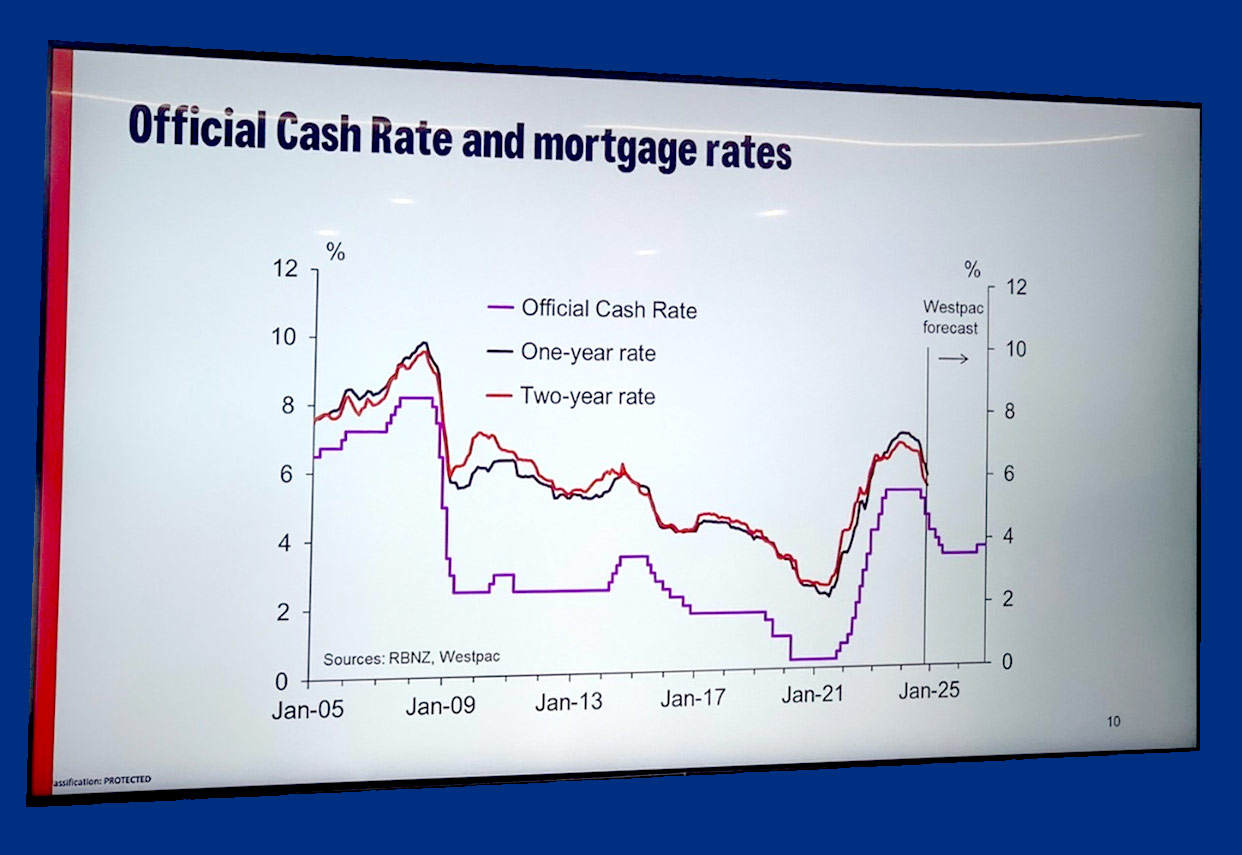

- Inflation and Interest Rates: Inflation has eased as spending declines, with high interest rates continuing to affect businesses and households. Despite challenges, South Island spending is steady, with stronger activity anticipated moving forward.

- Business Performance: Businesses face rising wages and operating costs which is impacting profits. Capital expenditure and new hires are expected to rebound slowly, likely in late 2025. Shortages in skilled labour persist but are projected to stabilise as pay increases align with inflation. With inflation lower now, wage increases will be lower. Reduced sales performance means there’s not such a demand for employees, allowing supply of labour to be equalling demand for employment. We are not seeing this with our clients though – there still seems to be a shortage of trained efficient labour available.

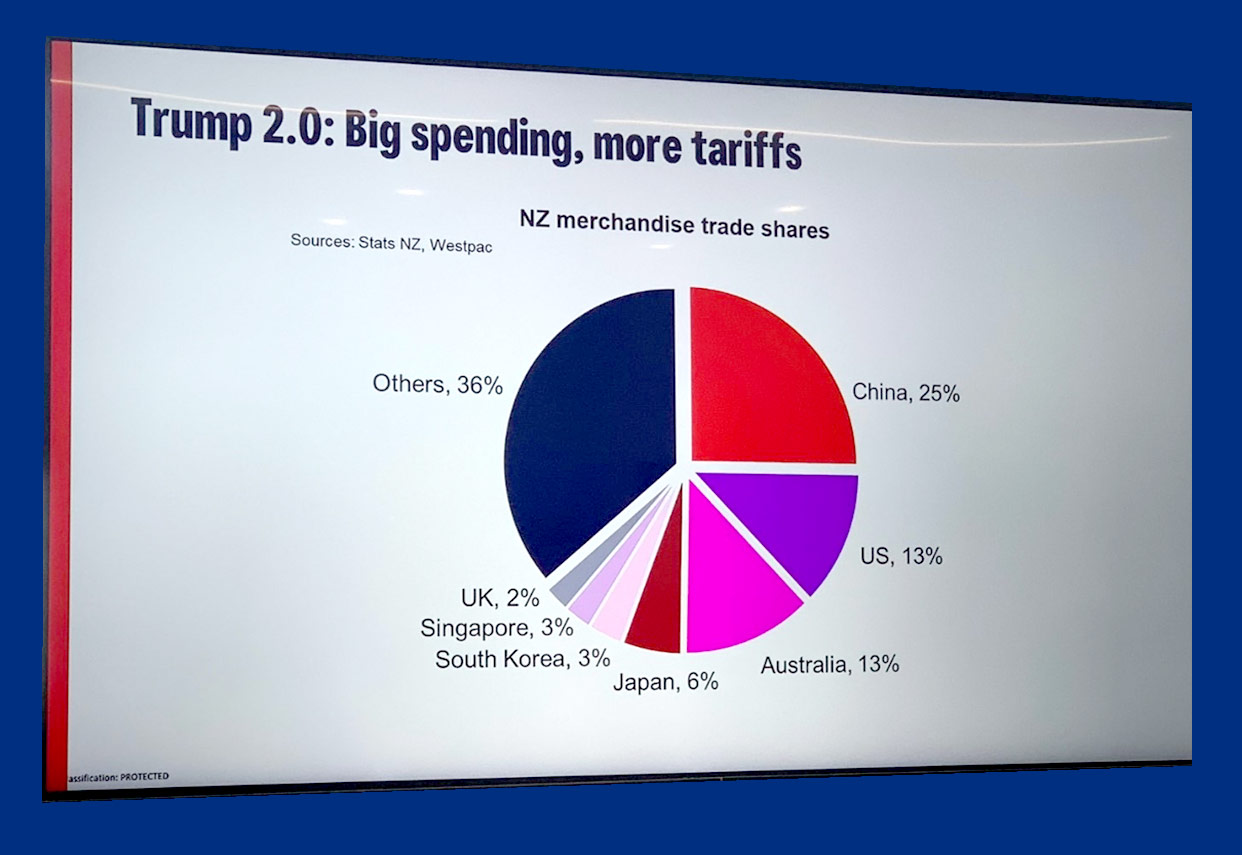

- Global Influences: International factors like U.S. policies from the Trump administration (e.g., potential tax cuts and tariffs) and economic conditions in China significantly impact New Zealand. A lower NZD exchange rate offers some export advantages, particularly for dairy, wine, and meat. Because China is one of our main exporters, any trouble they have with America will also have a ripple effect on us.

After attending the Exporters Advisory Group meeting last week, it became clear that China’s 100% tariffs on exports into America will have a ripple effect on New Zealand. China will need to export its goods elsewhere, most likely to New Zealand, Australia, and other European countries. This is concerning as cheap commodities may interfere with New Zealand-made products and services. Additionally, these tariffs could be detrimental to New Zealand businesses that manufacture in China or Mexico and then sell their products to America.

Specific Insights for Businesses

- Commercial Real Estate: The market remains mixed. Industrial properties perform well, while retail struggles. Commercial activity, especially in office refits, is expected to pick up when interest rates drop further.

- Debt and Liquidity: Businesses are relying more on overdrafts than term loans, indicating squeezed working capital. The rise in liquidations reflects increased debt recovery efforts by the IRD.

- Outlook: Westpac forecasts a modest recovery with economic activity potentially improving by 5-8% over the next year.

Action Points for Businesses

- Labour Strategy: Address labour shortages proactively while planning for incremental pay rises. Great time to have a lean efficient team and introduce AI where possible, while sales are lower and you have the time and labour to make changes.

- Debt Management: Review financing strategies and prepare for shifts in interest rates. Fixing rates now may avoid future uncertainty. The swap rates already have future predictions of the drop in the OCR built into them. This is a tough call, do you fix for 6 months, 12 months or even two years? It makes a good discussion as it’s a different scenario for every business. If you would like to discuss this further, please get in touch.

- Investment Timing: Consider delaying major investments in equipment or technology until conditions stabilise in 2025 unless you have the funds.

- Global Trade: Monitor developments in U.S.-China relations and exchange rate trends for impacts on import and export pricing.

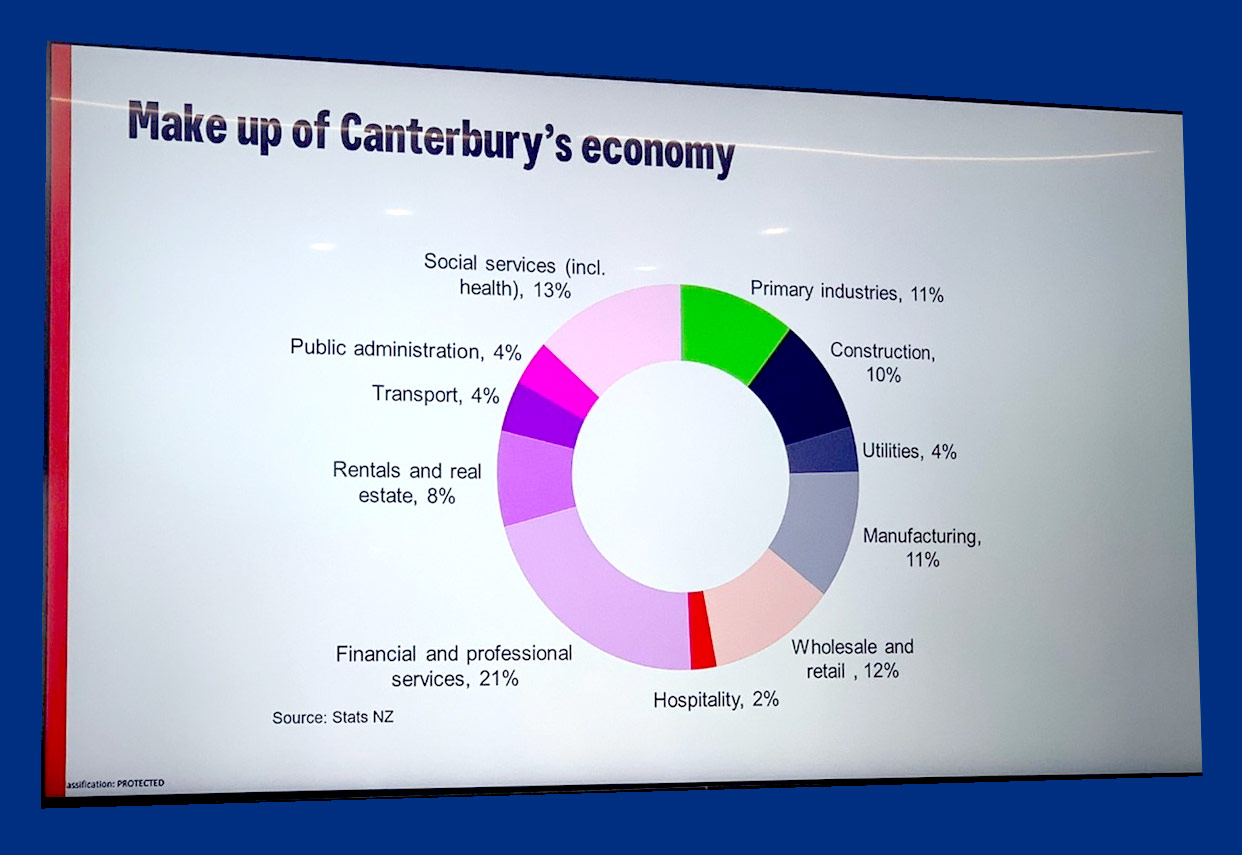

Canterbury remains well-positioned in this environment, with its resilience offering cautious optimism for growth over the next 6-12 months. This is a time where businesses can adapt to the market insights to mitigate risks and leverage emerging opportunities.

There are definitely opportunities out there. Taking a long-term thinking approach will assist you in seeing the opportunities sitting in front of you.