We’ve put together this list of changes for business owners arising from the 2025 Budget. We’ve written this from our personal perspective and hand-picked what we think is relevant to you. It’s well worth your time if you want to take full advantage of the opportunities.

To position yourself for these opportunities (and attract new customers along the way), focus on strengthening your business relationships, networking effectively, and ensuring your online presence is up to date – this includes both your website and social media profiles. Visibility matters. In today’s environment, lifting your profile increases the chances of these opportunities finding their way to you.

Key Takeaways

- The 2025 New Zealand Budget, with a reduced operating allowance of $1.3 billion, indicates the government’s belief in calming inflation and economic recovery, with forecasts of accelerated growth, 240,000 new jobs, rising incomes, and lower interest rates over the next four years. A new tax incentive, the “Investment Boost,” effective May 22, 2025, allows businesses to deduct 20% of the value of new assets (including second-hand and imported) from their taxable income in the year of purchase.

- Changes to the KiwiSaver scheme include increases in employer and default employee contributions to 3.5% from April 1, 2026, and to 4% from April 1, 2028; a decrease in the annual Government contribution to $260.72 from July 1, 2025; and eligibility for 16 and 17-year-old employees for contributions from April 1, 2026.

- Significant government investment in infrastructure projects, including over $1 billion for health facilities and $711.9 million for school property, as well as an additional $100 million for the Elevate NZ Venture Fund and $85 million annually for the new Invest NZ entity, aims to boost the economy, innovation, and attract global capital.

- Other notable changes include relaxed Thin Capitalisation Rules to encourage foreign investment in infrastructure, easier rules for Employee Share Schemes delaying tax for startups and unlisted companies, a new optional Revenue Account Method for Foreign Investment Fund (FIF) taxation, and simplified Fringe Benefit Tax rules for company vehicles and other employee benefits.

Table of Contents

- The Budget

- Investment Boost

- Changes to the KiwiSaver Scheme

- Investment into the Elevate NZ Venture Fund

- Establishing Invest New Zealand

- Changes to Thin Capitalisation Rules

- Easier Rules for Employee Share Schemes (ESS)

- New FIF – Revenue Account Method

- Fringe Benefit Tax Changes

- Additional IRD Funding for Compliance

The Budget

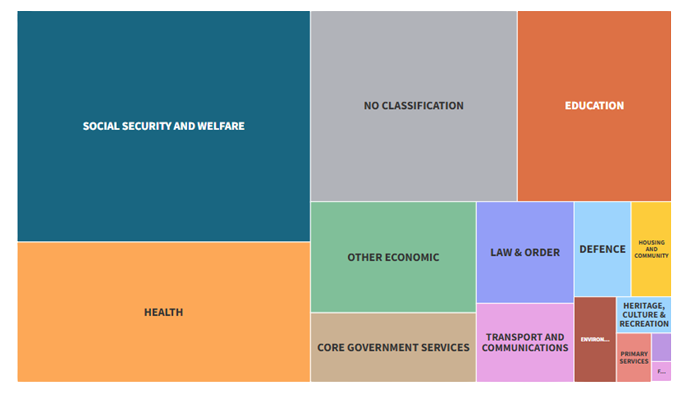

The 2025 New Zealand Budget had the lowest operating allowance in a decade – cut from $2.4b in new spending last year to nearly half at $1.3b. The graph below shows the areas where the budget spend has been allocated.

Click the link below to see this diagram become interactive – it drills down to show a more detailed breakdown of spending. (You will need to scroll down to see this).

Breaking it down: Budget 2025 in charts | RNZ News

The Government believes that inflation has calmed, and recovery is now underway, which is in line with what we are seeing with the majority of our clients. Treasury are forecasting that growth will accelerate over the next 4 years, bringing 240,000 additional jobs, rising incomes, lower interest rates and an end to mounting debt. Growth will mean there will be more opportunities for NZ businesses through increased demand, lifting sales & revenue.

The Government believes that inflation has calmed, and recovery is now underway, which is in line with what we are seeing with the majority of our clients. Treasury are forecasting that growth will accelerate over the next 4 years, bringing 240,000 additional jobs, rising incomes, lower interest rates and an end to mounting debt. Growth will mean there will be more opportunities for NZ businesses through increased demand, lifting sales & revenue.

Spending in the budget for businesses was mainly focused on increasing investment, productivity and supporting long-term economic growth. Some of the announcements included that will affect you as a business owner include:

1. Investment Boost

A new tax incentive to encourage investment, technology and growth. From 22 May 2025, businesses will now be able to deduct 20 per cent of new assets (including second-hand and new assets if imported from overseas) value from their taxable income in the year of purchase. To see what the Investment Boost does and does not cover, click here.

Eg. If you purchased an asset covered by the Investment Boost that cost $200,000 you can get a $40,000 deduction, then when this amount is taxed at the company rate of 28% this would reduce your tax expense by $11,200. The remaining $160,000 would then be depreciated as usual under the standard depreciation rules. (Unless it is an asset that cannot be depreciated or something like a commercial building that has a zero-depreciation rate).

If you are a client, please notify us when you have purchased an asset covered under the investment boost, so we can ensure it is included in future provisional tax calculations.

2. Changes to the KiwiSaver scheme

The employer will be covering some of the Government savings through increased employer contributions (great for employee savings!):

- The default employee and employer contributions will increase from 3 to 3.5% on 1 April 2026, then to 4% from 1 April 2028. Employees will be able to temporarily opt down to the current 3% minimum contribution rate, and in this case, the lower rate can be matched by the employer.

- From 1 July 2025, the annual Government contribution will decrease from $521.43 to $260.72. Individuals earning over $180,000 annually will no longer be eligible for the contribution.

- From 1 April 2026, employees aged 16 and 17 will become eligible for employer and Government contributions, provided they make personal contributions.

3. New Infrastructure Projects for Schools and Hospitals

Over $1 billion dollars has been designated towards health infrastructure projects to redevelop and enhance facilities nationwide.

$711.9 million of capital funding is being allocated towards the school property portfolio to deliver learning support facilities, new schools, classrooms and land for future school sites.

There may be opportunities for some of our clients to participate in the work that arises from these projects.

4. Investment into the Elevate NZ Venture Fund

$100 million has been invested in the Elevate NZ Venture Fund to support innovation and boost high-growth technology companies. These outcomes should help improve productivity and efficiency within businesses.

We will give you more updates on this as it becomes available.

5. Establishing Invest New Zealand

$85 million per year, over the next four years, is being invested in a new Crown entity called Invest NZ, which will help attract global capital, businesses, and talent to New Zealand Industries.

We will give you more updates on this as it becomes available.

6. Changes to Thin Capitalisation Rules

Thin capitalisation was introduced in New Zealand to prevent multinational companies from shifting excessive amounts of debt into the country to gain unfair tax advantages by deducting interest payments, which then reduce taxable income.

In the budget the Government said they are looking to modify these rules so we can encourage foreign investment in infrastructure. The relaxation of these infrastructure projects is expected to result in $65 million in lost Government revenue over the next four years, as it enables higher debt levels and higher levels of interest deductibility for eligible infrastructure projects in New Zealand. Read more here.

This will be excellent for boosting projects, infrastructure and business within New Zealand, so make sure you are visible so you have the opportunity to be included.

7. Easier Rules for Employee Share Schemes (ESS)

If you receive shares in a company through a share scheme, you usually have to pay the tax upfront when the ownership is transferred to you, even if you can’t sell them yet.

Under the new rules, employees at startups and unlisted companies can delay paying tax on those shares until they sell the shares or the company becomes public, such as through an IPO.

The main negative aspect of this is that you may end up paying more tax later, as the company’s value will likely be worth more by the time you sell the shares.

8. New FIF – Revenue Account Method

New Zealand has a tax rule called the Foreign Investment Fund (FIF) regime. It taxes earners each year on unrealised gains over $50,000 — meaning you can be taxed even if you haven’t sold your overseas shares or received any money from them. The Government is introducing a new optional RAM method to help retain and attract high-value migrants and returning citizens.

The RAM method would tax dividends and 70% of capital gain amounts on a realised basis. It would only apply to unlisted foreign shares held prior to being tax resident in New Zealand. It’s attraction is that tax is only payable on receipt of dividend income or the sale of shares, i.e., when the income is available to meet the tax obligation.

9. Fringe Benefit Tax Changes

The Government is making Fringe Benefit Tax easier to work with, in particular for company vehicles and other non-cash employee benefits.

If you provide a vehicle for your staff, the tax will be based on the intended use of the vehicle (e.g. business vs. personal). This means less paperwork, but you could end up paying more depending on how the vehicle is used.

For other employee benefits, such as gift cards and tickets, you will only need to track and report items over $200 each. The old limits of $300 per employee per quarter and $22,500 per employer per year will be removed once this becomes law later this year in the Government’s Omnibus Tax Bill.

From our understanding of the current information provided, we believe if you purchase 2x $200 vouchers in separate transactions for your employees this won’t have any FBT, however if you buy one single voucher that is over $200, then FBT will apply to this. We will send you an update once this becomes law.

10. Additional IRD Funding for Compliance

The Government is contributing an extra $35 million in funding to support Inland Revenue’s tax compliance and debt collection activities. If you don’t think you can pay your tax on time it’s a good idea to at least get yourself on a payment arrangement, and stick to this, so it stops any further action from happening.

If you have any questions or concerns for how some of these Budget updates could affect your business, please feel free to contact us on 03 374 9393.