Cashflow is a business’s lifeline. Without it, there’s a significant chance a business will cease to exist; even if it’s profitable.

Wondering if your cashflow is worth taking time to think about? Then consider this. If you are:

- Unable to cover your total monthly expenses easily with your total monthly income;

- Not being paid your desired wage;

- Unable to pay all your taxes.

Then you have a cashflow management problem.

If you’re breaking out in a sweat right now, rest easy, there are ways to improve your cashflow but first you must understand what cashflow is and how it circulates around your business.

Cashflow is the flow of money coming in and the flow of money going out. How much cash you have in your business at any one time (cashflow) is determined by how much cash you have coming in less how much cash you have going out.

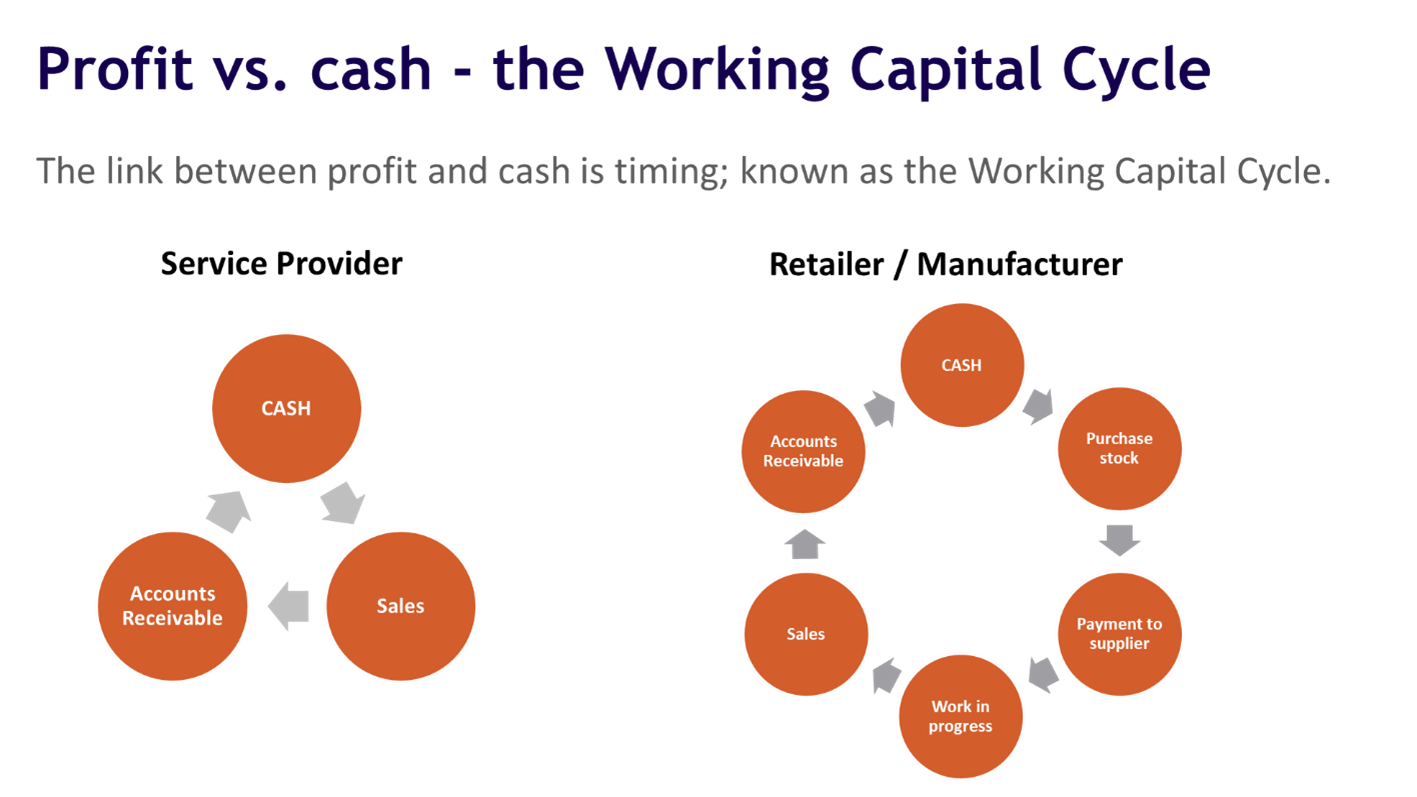

Cash circulates around your business. You manufacture or produce goods (cash out) and then you sell them (cash in) and on it goes. It sounds simple, and it is. However, it’s the processes that surround this cycle that often create timing issues.

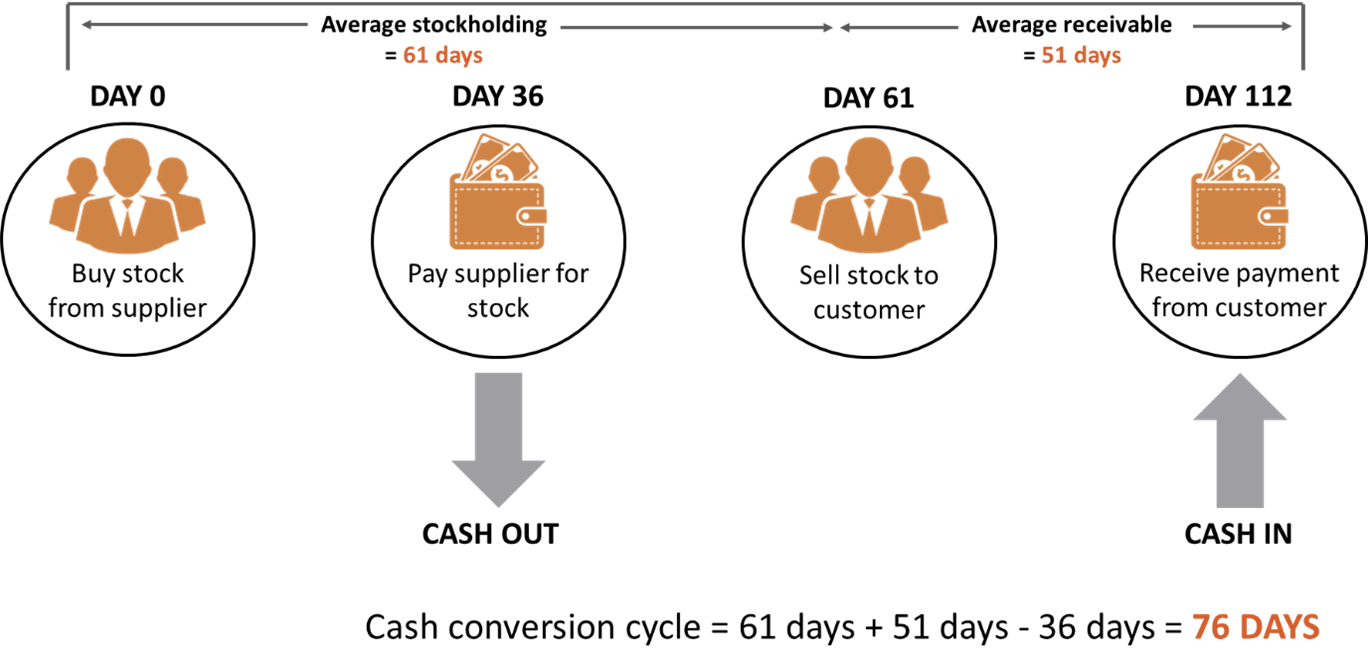

The length of time it takes you to purchase your goods and have these goods convert into cash in the bank is called your Cash Conversion Cycle. The less time this process takes, the better your cashflow and when your cashflow works for you it’s easier to cover your monthly expenses, pay yourself your desired wage, cover your taxes, and avoid having unnecessary debt.

Here’s an example of a Cash Conversion Cycle calculation:

The Cash Conversion Cycle gives you clarity around how long it’s taking between cash going out and cash coming in; in this example it’s 76 days.

Simply by working out this calculation the business owner has gained valuable insight into why and how their cashflow is impacting their business.

Reducing the number of days in this cycle significantly improves the business’s cashflow and this can be achieved by taking a closer look at your business processes.

For example if Accounts Receivable days reduced by 9 days and Inventory days reduced by 6 days there would be an additional $105,370 in your bank account today (presuming Sales are $3,000,000, Accounts Receivable $420,000, Cost of Goods Sold $1,910,000 & Inventory $320,000.)

There are 7 areas which contribute to the length of your Cash Conversion Cycle and below we’ve given you a link below with some ideas on how to begin reducing the number of days in each area and start enjoying better cashflow today:

- Accounts receivable

- Accounts payable

- Inventory process

- Inappropriate debt/capital structure

- Overheads too high

- Gross profit margins too low

- Sales levels too low

Please follow this link to find out how to reduce the cash conversion days in these 7 areas.